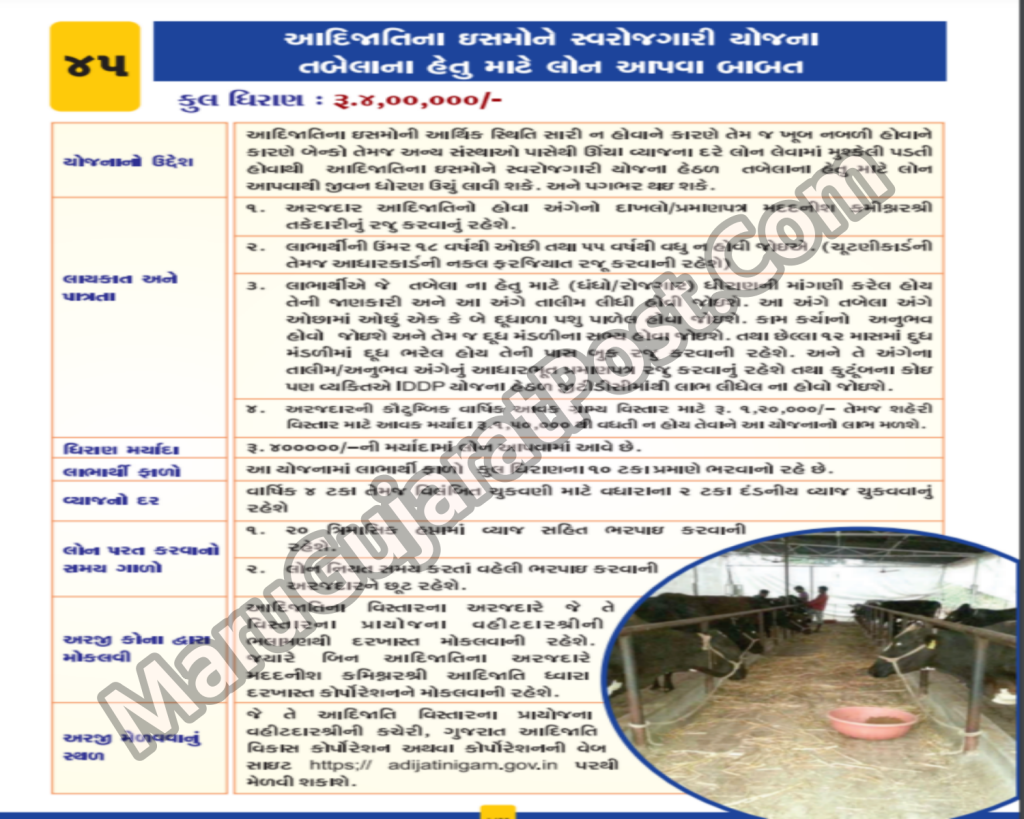

Tabela Loan Yojana Gujarat 2022, કૃષિ વૈવિધ્યકરણ યોજના 2022 , The pastoralists and farmers of Gujarat will get a loan to build stables for their cows and buffaloes under this scheme. People who have a lot of cows and buffaloes need to be able to build stables in a good place to take care of the people. Under which Pashupalan Loan Yojana 2022 Gujarat will be given under self-employment scheme. To get this loan, one has to apply online from Adijati Gujarat Website.

The Highlights of Tabela Loan Yojana Gujarat 2022

Table of Contents

| Name of the scheme | Loan scheme for stables |

| The language of the article | Gujarati and English |

| The purpose of the plan | Beneficiaries of Scheduled Castes of Gujarat can be brought up to the standard of living and given a foothold by providing loans for the purpose of stables under the self-employment scheme . |

| Beneficiary | Citizens of Scheduled Tribes of Gujarat |

| Loan amount under the scheme | Under this scheme loan up to 4 lakhs is given to the beneficiary. |

| Interest rates on loans | 4% per annum as well as additional 2% penalty interest for late payments. |

| Official Website | Click Here |

| Online Apply | https://adijatinigam.gujarat.gov.in/gtdcloan |

Overview Of Tabela Loan Yojana Gujarat 2022

Eligibility for loan : Tabela Loan Yojana

- The applicant must have a certificate of ethnicity.

- Applicant age should not be less than 18 years and not more than 55 years.

- Those who have annual income of Rs. 1,20,000 / – for rural area and Rs. 1,50,000 / – for urban area will get the benefit of this scheme.

Tabela Loan Yojana Required Documents:

- Certificate of Scheduled Tribes (Example of Competent Officer)

- Copy of Ration Card of the applicant

- Bank account passbook

- Copy of Aadhaar card

- Proof of property submitted by the applicant (building documents and property card which is recent and 7/12 and 8-A of land or without burden)

- 7-12 and 8-A of the guarantor-1 or documents and property card of the building

- Government Approved Valuation Valuation Report on Property submitted by Zamindar-1

- Government Approved Valuation Valuation Report on Property submitted by Zamindar-2

- Bailiffs will have to submit affidavit affidavit on stamp paper of Rs.20 / –

આ પણ વાંચો :

Tabela Loan Yojana Online Form Submission

- Beneficiary will have to enter the details of the application, details of the property of the applicant, details of the loan, details of the guarantor etc. while filling his application information online.

- In which the loan amount has to be paid in the next column by selecting “Loan Scheme for Stables” in the selection of scheme.

- You have to upload the property details, bank account details, other required documents as you have decided.

- After filling all the details online, the application has to be checked again and saved.

- The number of saved application will be generated. Whose print must be taken and preserved.

Important links of Tabela Loan Scheme

| Adijati Nigam Gujarat Official Website | Click Here |

| Direct Online Apply for Tabela Loan Scheme | Apply Now |

| Login here | Click Here |

| Register Here | Click Here |

| Download Mahiti App | Click Here |

| Home Page | Click Here |

How much credit is provided under Tabela Loan Scheme?

Beneficiaries are given a total loan of Rs. 4 lakhs on Tabela loan scheme.

What is the interest rate of loan given under Stable Loan Scheme?

This loan is given to start a new business of stable loan.

The interest rate is only 4%.

Who is the beneficiary of Tabela Loan Scheme?

Adijati Vikas Nigam, Gandhinagar to be a native of Gujarat and a citizen of a Scheduled Tribes (ST).

આ પણ વાંચો :